Recently, Pakistani cable manufacturers have asked to enjoy similar tax policies for Chinese and other importers.

Cable manufacturers said that at present, for the China-Pakistan Economic Corridor project for the import of wire and cable to provide tariffs and sales tax policy, which promoted imports from China, but it is the cost of the local wire and cable industry.

According to official data, 88% of wire and cable imports (or $ 21 million) came from China in the first quarter of this fiscal year.

In the latest budget, the government is exempt from tax on imported wire and cable, materials and equipment for the development of Gwadar and the Free Economic Zone. However, these tax exemptions are not targeted at local products.

In addition, the benefits provided to the SEZs business only apply to joint ventures established with foreign partners. Some general customs will also distinguish between local and imported wire and cable.

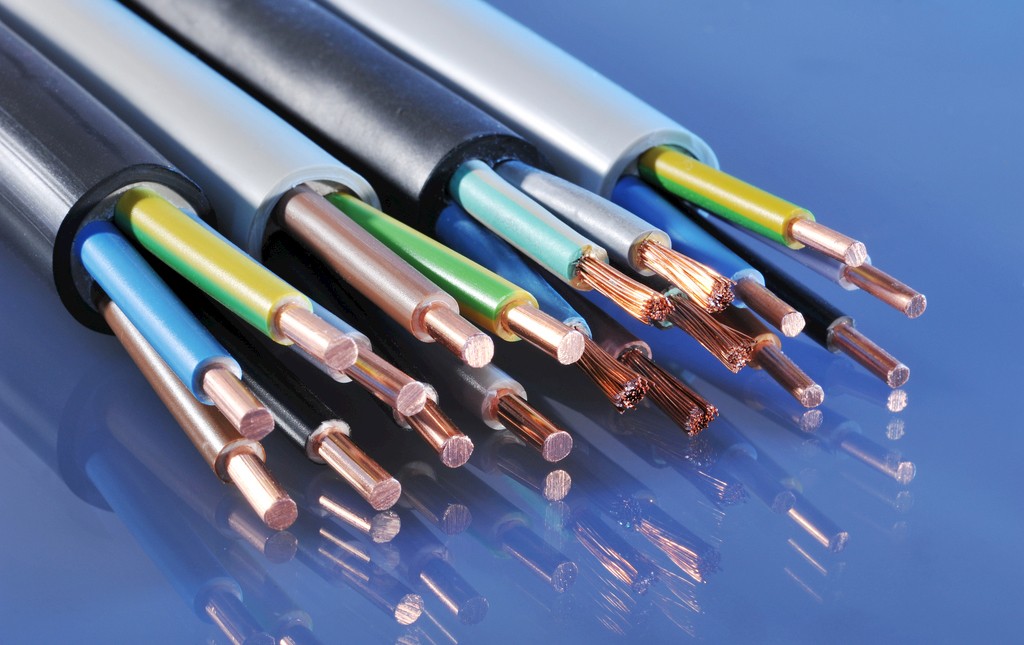

Local cable manufacturers include the joint industry, Atta cables, Eagle cables, quick cables, H.M. Esmail, New Century cables, Pakistan Cable companies, steel conglomerates and the global cable industry.

China announced the investment in the power industry 36 billion US dollars, which will be conducive to the Pakistan cable business.

25 MW and above power plants are allowed to import wire and cable with lower tariff and zero sales tax.

However, if these power items are purchased from a local manufacturer, a 17% sales tax must be paid. Local manufacturers also want to impose a zero sales tax on more than 25MW power plants.

Most of the major raw materials in the wire and cable industry are not produced in Pakistan. Over the years, the tariffs on raw materials have been rising.

Which makes the local cable industry and imported products compared to a smaller competitive. For example, the tariffs on electrolytic copper and aluminum ingots are 3% and the additional tariff is 1%.

Local cable manufacturers also require a 10% tariff on certain products to protect local.