In 2020-2021, the COVID-19 epidemic raged around the world. Affected by the epidemic, the global copper exploration investment has decreased, development projects have been stalled or canceled, production has reduced, and the copper market has been violently shaken.

At the same time, the antibacterial function of copper has been explored, and anti-epidemic products containing copper have been drawn up and applied. As countries increase efforts to support the green economy, copper consumption will rise sharply and demand will continue to outstrip supply.

Global copper exploration investment in 2019 was $2.319 billion, up 11.84% year on year, and decreased by $546 million in 2020 due to the COVID-19 epidemic.

Lockdowns unpaid to the pandemic have forced investment in some major copper mine construction projects to be delayed or suspended. Of these, 23 projects in Chile with a total investment of US $44 billion have been delayed due to the pandemic, including Spence and Inka copper projects.

Similarly, some copper mine construction projects in Peru, South Africa, the Democratic Republic of Congo (DRC) and other countries are also impacted on varying degrees. Mining investment in Peru fell by 25% in the first half of 2020, with significant reductions in copper projects such as Tromoc, Antamina and Claviko.

China's copper exploration investment has declined for five consecutive years, from a peak of 5.619 billion yuan in 2014 to 630 million yuan in 2019.

Scheduled to the COVID-19 epidemic and other factors, the global copper trade pattern has changed greatly. Despite the decline in Chilean copper exports in 2020, exports were still up 8.3% from 2019.

At the same time, Chile's exports of copper-containing products will triple in 2020, mainly copper-containing fabrics and daily necessities used for COVID-19 prevention and control. These innovative and high value-added products have opened up broad space for new uses of copper in epidemic prevention and control.

Peru, the world's second-largest copper exporter, saw its copper exports will fall 22.7% in 2020, while exports fell 17.7%. Copper exports from countries such as Australia, Zambia and the Democratic Republic of Congo have also been hit by the pandemic and trade policies.

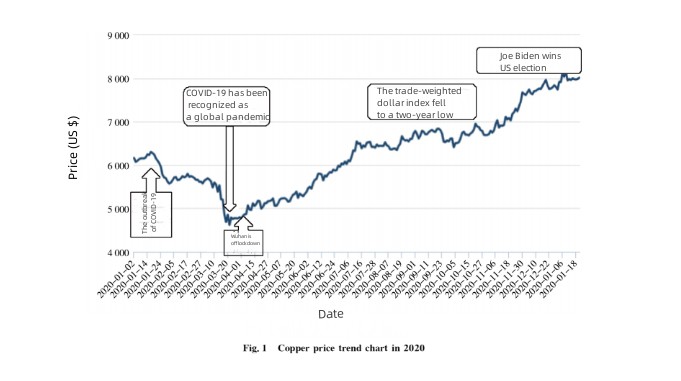

In 2020, the global copper price will show a trend of inhibition before rising. Affected by the outbreak of COVID-19 at the beginning of the year, the international copper price fell dramatically.

LME copper futures price fell from $6165 / t at the beginning of 2020 to $4617.5 / T at the end of March, with a decline of 25.1%.

Copper prices then started the rally, hitting a December 2020 highs of $7,984, up 72.9% from the year's low.

Although the pandemic began earlier this year, it has had little impact on global copper production, with the affected mines accounting for just 1.5% of the world's projected total output. Chile, the world's largest copper producer, produced roughly the same amount in 2020 as in 2019, at around 5.8 million tonnes.

In the second half of 2020, major economies led by the United States introduced trillions of dollars of economic rescue measures, leading to the global monetary liquidity easing, the dollar price index was still depressed. Peru's copper mines have been hit by COVID-19 pandemic and domestic politics. International copper prices continued to increase on the back of a combination of strong Chinese economic data.

The global economy contracted in 2020, with GDP growth of -4.9 percent in advanced economies and -2.4 percent in emerging and developing economies, according to the World Economic Outlook published by IMF in January 2021.

In 2021, the global economy will be expected to grow 5.5 percent, with advanced economies expanding 4.3 percent and China expanding 8.1 percent. There is still considerable uncertainty in this projection, and the economic situation will improve if progress is made on vaccines and treatments. Countries cooperate and provide more policy support.

Conversely, if the outbreak continues to recur or the vaccine performs less well than expected, it will have a critical influence on global economic development and the overall copper market.

Production at the currently affected mine in Peru's Las Bambas and other mines in Latin America could be effectively restored, assuming the outbreak can be effectively contained.

In addition, the Kamoa-Kakula mine in the Democratic Republic of Congo, the Kvladablanca mine and the Spence mine in Chile are expected to come on stream in 2021, the Udokan mine in Russia and the Claviko mine in Peru in 2022, Mongolia's Oyu Tolgoi copper mine is set to complete its expansion in 2023.

The projects, if successful, are called upon to add 111,000 tonnes of copper concentrate to global output each year. On the domestic front, copper concentrate production is also expected to increase slightly in the next few years, with expansion projects at the Chengmun Mountain and Yulong copper mines expected to be completed in the next two years, adding 50,000 tons of annual output, but these increases won't change the tight global supply situation in the short term.

Copper is employed in a wide range of fields, including electricity, air conditioning refrigeration, transportation, electronics, construction, military and other traditional fields, including wind power infrastructure and new-energy electric vehicles and other emerging fields.

Copper consumption in customary areas has shown a positive correlation with the growth of global GDP in recent years, and the consumption fluctuation range is small. In terms of emerging industries, the development of wind power generation and new-energy vehicles will significantly boost global copper consumption.

In the field of new-energy vehicles, China's 14th Five-Year Plan period will accelerate the development of novel new-energy vehicle industry. The United States rejoined the Paris Agreement, actively promoted the production of green new-energy vehicles, vigorously developed new-energy, and expanded investment in public transportation. Germany extends subsidies for electric cars. Britain will ban the sale of modern petrol and diesel cars from 2030. In the field of renewable energy, wind power has become the renewable energy technology succeeding only to hydropower in terms of installed capacity.

In addition, in the context of the global COVID-19 pandemic, copper's antibacterial function has been excavated, expanding the new application domain. Owing to the natural antibacterial and self-disinfecting properties of the copper alloy surface, which can eliminate 99.9% of harmful bacteria and viruses, the anti-microbial properties of copper coated films have been tested in high-throughput vehicles in Canada.

Chile has developed a kind of copper stickers, which are used on everyday objects and building surfaces. A copper-containing spray called Aircop is being used as a garbage collector in Santiago, and another product called copper-mail is being used at the University of Chile's COVID-19 ward.

Products such as copper 3D printed face masks. Elevator and ATM buttons have been widely used. In the future, similar copper-containing epidemic prevention products will be widely used in People's Daily life after being fully demonstrated, and the driving global copper demand is also worth paying heed to.

Copper is employed in a very wide range of areas, and the consumption structure of countries is also different. According to the statistics of the United States Geological Survey, the copper consumption areas in the United States are mainly: construction (43%), electricity (21%), transportation (19%), consumer goods (10%), industrial machinery and equipment (7%), etc.

Owed to a number of factors, such as the continued slowdown in global economic growth caused by the COVID-19 pandemic and increased geopolitical uncertainty, the traditional application areas of major copper demand countries will not see significant growth.

Among them, the eurozone economy and the manufacturing sector continue to weaken. Japan and South Korea will continue to maintain low growth in Asia, and the economic recovery of the United States is also uncertain. The above countries and regions is not strong drivers of copper consumption in the next five years.

In terms of consumption, foreign countries have invested less in infrastructure in recent years, and copper consumption has been leveling off, but is impossible to that the United States will invest a large amount in domestic infrastructure construction in the next few years.

In recent years, the electronic communication industry has developed rapidly and the frequency of replacement is relatively prominent, but the market tends to be full. Consumer goods are limited by the growth of people's mouth. The future is expected to increase less space. With the development of new energy vehicles in the field of transportation, the amount of copper will use in the future will continue to rise.

Global refined copper consumption has been growing at a low rate of about 1.5% in recent years and is not intended to change much in the next five years, driven by wind power and new energy vehicles.

According to the "global wind energy flagship report 2019" released by the global wind energy council, by the end of 2019, the cumulative installed capacity of global wind power exceeded 650GW, an increase of 10% compared with 2018. Of that, 3.6GW was added in China, 2.7GW in Europe and 1.6GW in the US.

According to IRENA, the world is expected to add 541GW of wind power capacity during 2021-2025, with an average annual growth rate between 10.6% and 19.8%. According to the calculation, the amount of copper used per megawatt of wind power generator group is 2.5 ~ 6.4T (generator 1.1 ~ 4.0T; Wire 0.7 ~ 1.0T; transformer 0.7 ~ 1.4T). According to this recent trend, the amount of copper used in wind power generation globally will reach 1.35 million to 3.46 million tons by 2025, with an average of 2.408 million tons. 表2

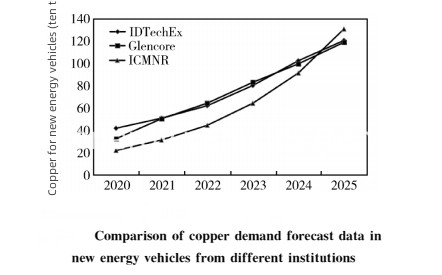

The motors, wires and charging piles used in innovative new-energy vehicles all require copper. Most internal combustion engine cars use only 23kg of copper per car.

However, the copper consumption of new-energy vehicles such as hybrid electric coupes, plug-in hybrid electric cars and pure electric cars is much higher than that of traditional internal combustion engine vehicles (Table 3), and the average copper consumption of new-energy electric vehicles is 94kg/vehicle. In addition, the average copper content of fast charging pile is 60kg/piece, and that of slow charging pile is 5kg/piece.

According to World EV Outlook 2020, the world will sell 14 million nevs annually and 50 million nevs cumulatively by 2025.

The global demand for copper in the field of new-energy vehicles will increase from 223,000 tons in 2020 to 1.302 million tons in 2023, with an average annual growth rate of 30%, and an average annual increase of about 215,800 tons of copper and gold.

The sales volume of fresh new-energy vehicles also rose from 80,200 in 2011 to 1.206 million in 2019, accounting for 4.70% of the total sales volume from 0.04%.

In the next five years, on the premise that the global economic development and political environment will not fluctuate significantly, it is expected that the global copper market will develop stable and continue to be under the environment of supply shortage.

Much of the increase in global supply has been driven by increased smelting capacity in China, with limited expansion elsewhere. Driven by the booming development of wind power facilities and new-energy vehicles, the global copper demand has a steady growth trend.

The new global copper demand is mainly in the construction of wind power facilities (309,500 t) and new energy source vehicles (1.079 million t). By the end of 2025, the total increase in demand is about 1.388,500 t, with an average yearly growth rate of 29.5%.

Under the development tendency of constant increase in demand, the global copper supply and demand environment will maintain the situation of short supply, and the supply shortage is constantly expanding. According to S&P's forecast for the entire copper supply and demand market, the global copper supply will continue to remain tight in the coming years. S&P Global Intelligence will put global copper supply at 27.436 MLN t in 2025, demand at 27.486 MLN t and supply short by 50,000 MLN t.

In 2025, the global copper demand will reach 25.17 million t, the new copper demand is mainly in the construction of wind power facilities (309,500 t) and new energy vehicles (1.079 million t), the total increase of demand is about 1.388,500 t.

Global copper supply and demand will remain in short supply. The supply shortage is widening.