On Thursday, the Shanghai copper main contract 1809 oscillated and rebounded. It traded at 50290-49750 yuan/ton in the day and closed at 50140 yuan/ton in the end, up 0.46% on the day, rising for the fourth consecutive day. In terms of term structure, Shanghai copper futures maintained a near-low and high positive alignment.

The positive spread between Shanghai copper 1808 contract and 1809 contract expanded to 140 yuan/ton, indicating that the willingness to rebound in the forward contract is strengthened.

In terms of external market, the Asian city's copper was under pressure, especially after the Shanghai copper closed, the decline rate accelerated, the trading range was 6378-6259 US dollars / ton, of which 16:20 Beijing time, 3 months, the copper price of 6,273 US dollars / ton The day fell 0.47%. In terms of positions, as of July 24, the number of positions in Luntong Copper was 309,000, a decrease of 2,143 lots per day. Recently, the price of copper was reduced, indicating that the short position was actively profitable.

In terms of market, on July 26, Shanghai Electrolytic Copper spot was posted on the monthly contract for 90 yuan/ton - discounted 50 yuan/ton, and flat water copper was sold at 49,850 yuan/ton-49950 yuan/ton.

The continuous increase in the supply of goods has increased the willingness of the holders to redeem the goods, and the discount has been further expanded. Early morning good copper offer premium 40-adhesive 30 yuan / ton, flat water copper offer premium 70 yuan / ton, the overall transaction is weak, good copper leading down to report to the discount of 60 yuan / ton, flat water copper offer downgrade stickers Water 90-adhesive 80 yuan / ton, wet copper down to 140 yuan / ton, downstream consumption is still weak, the market is very small, the long single market after the end of the long single market is weak, difficult to provide, oversupply is obvious.

As the weekend approaches, the number of smugglers increases, the willingness to trade speculation is low, and the pace of discounting the discount is accelerating. If the discount can be fully expanded to more than 100 yuan, it may attract some speculators to enter the market.

On the macro side, the Asian dollar index rebounded and is now trading at 94.18. The total number of new home sales in the United States in June was 631,000, which was lower than the expected 668,000. The current market is focused on Friday's US second quarter GDP, which is expected to grow by as much as 4% in the second quarter.

In terms of industry, it is reported that the Peruvian president will announce the launch of the Quellaveco copper project, which will produce an annual average of 300,000 tons in the first 10 years, higher than the previous estimate of 225,000 tons.

During the day, the Shanghai copper 1809 contract oscillated to rebound to 50,140 yuan / ton, because the Chinese government will use the joint efforts of finance and finance.

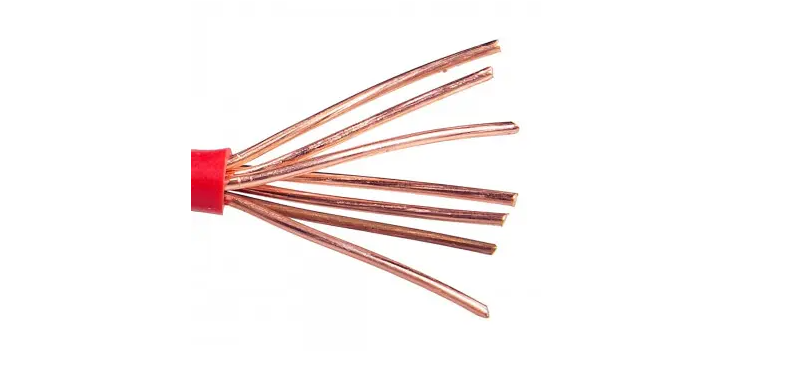

However, after the Shanghai copper market closed, the copper pressure fell, showing that the bulls rallied positively, and the short-term need to be alert to the technical correction after the continued rebound. It is suggested that the Shanghai copper 1809 contract can be low and low at 49,500-50,200 yuan/ton. Damage is 450 yuan / ton each. copper cable will lower in cost then.