The wire and cable industry might be mature, but there are still plenty of growth markets, including telecommunications, construction, and automotive.

But prices for steel, copper, and metals will be heavy directional influencers.

Raw material volatility poses among the greatest threats to stable prices and production costs in many cable and wire markets, experts say.

But positive news in the construction and telecommunications sectors, upon which much of the growth of these markets depends, promises to keep prices steady in the next few years.

Are incredibly diverse and broad, with their biggest end-users being telecommunications and power companies.

Their applications are ubiquitous across so many industries, including commercial and residential construction.

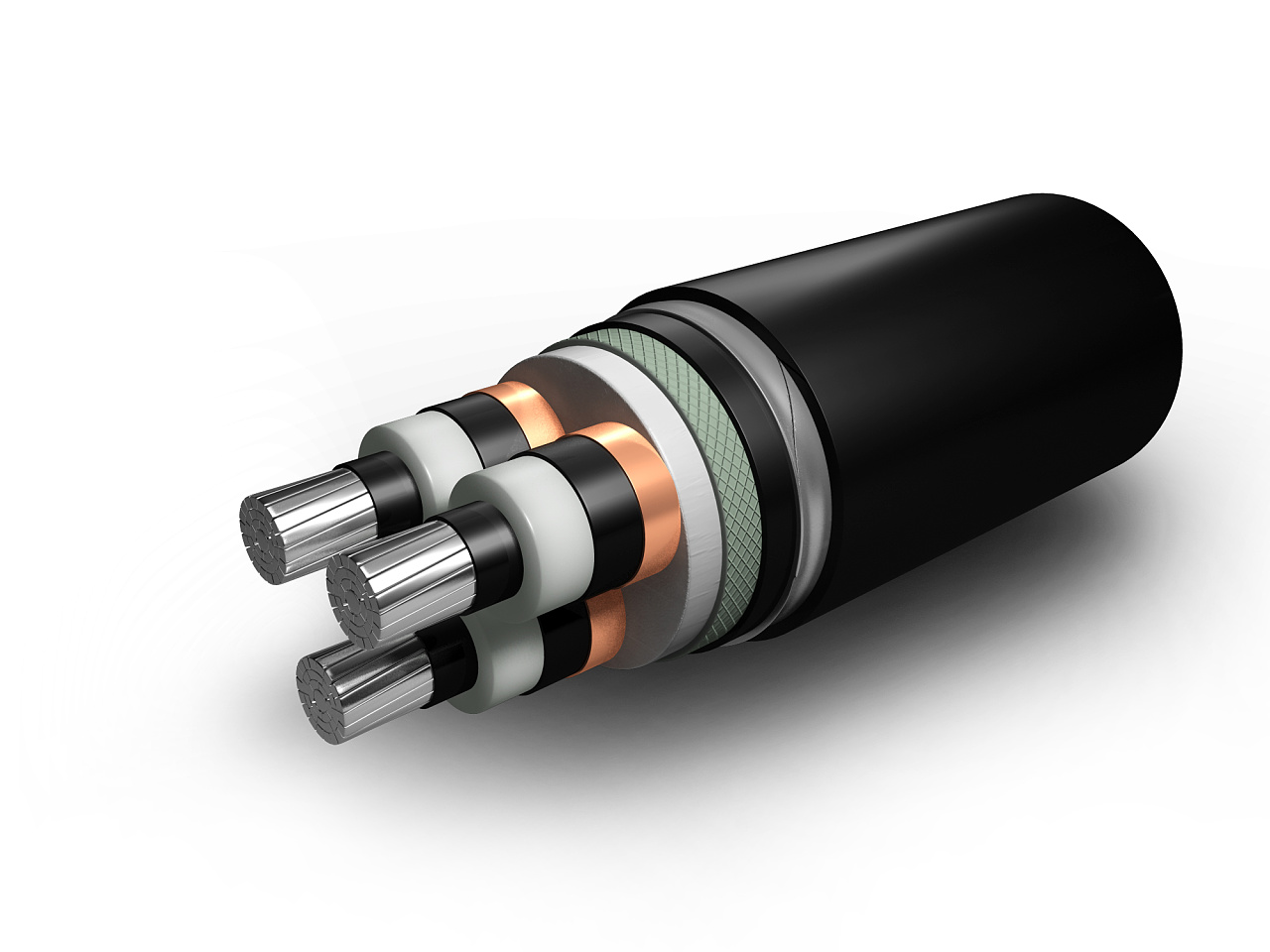

Some of the most common components include rubber, copper, aluminum, and various plastics, including thermoplastic and thermosets.

These markets are characterized by a vast and diverse range of manufacturers and suppliers across the world.

Because marketing costs for electrical cables, non-electric iron and steel wire, and mechanical cables are historically very low, producers typically invest most in innovation.

Moreover, price competition is stiff because of the sheer number of producers, as well as the plethora of cheaper foreign producers.

As reports that electrical cable products are in the growth phase of the product life cycle and include coaxial cable, halogen-free cable, multi-core cable, and axial cable.

Manufacturers, wholesalers, and retailers -- both foreign and domestic -- are all major suppliers.

Which are widely used for lifting, towing, or hauling, and are generally produced with high-carbon and stainless steel as well as nonferrous metals.

Mechanical cables are used heavily in the construction, mining, and oil drilling industries. Suspension bridges use an extensive amount of mechanical cable.

Non-electric iron and steel wire end-products include low- and high-carbon, hand-drawn, and stainless steel wire, as well as wires that are stranded, oil tempered, or used in pre-stressed concrete applications, according to the firm.